so you want to get into energy

high-level intro to the future of clean energy x tech x policy

I believe the two most consequential transformations of this decade are AI and the clean energy transition. Both are vital to handle well - massive in scale, riddled with complexity, and with the potential to either go cataclysmically wrong or accelerate societal progress.

Fascinatingly, these transformations are increasingly intertwined. Data center electricity demand alone - driven by the AI arms race - is expected to more than double by 20301 and create pressure on our already strained energy systems. As AI adoption grows, demand only increases.

Clean energy is a multi-trillion dollar shift that will define us. If we don’t solve for reliable, 24/7 renewable power, we risk deepening grid instability at precisely the moment we need to be decarbonizing it. But handled correctly, we could unlock a new era of sustainable, high-output power systems and democratize power. I’m very interested in how AI itself can aid in this transition.

This newsletter aims to provide newcomers to this notoriously complex space (regulation, infra challenges, market dynamics) with a high-level map of the landscape and lay the groundwork for explorations of emerging opportunities and white spaces.

Why I’m writing this

My interests lie at the intersection of energy x tech x policy. I’ve spent the past 2 years scaling a B2B enterprise SaaS startup from Series A to B, managing everything from product & ops to GTM strategy, finance, people, and compliance. But my roots in climate tech go back further - from debating the viability of carbon credits in high school and studying policy at Duke to working with HVAC startup Sealed during my time at McKinsey.

This perspective has convinced me that entrepreneurial people should be running towards, not away from, the hardest problems in gnarly spaces like energy. Through this newsletter I’ll share:

learnings, resources, and ways of thinking about these issues that I wish I would have had when I was first interested in the space years ago

side projects I’m working on to explore specific challenges

resources I like, listed at the end

The future is electric! Let’s go.

There are many things a newcomer should know about energy. Three to start are:

There are competing truths. Depending on where experts focus (gen vs. transmission vs. distribution, utility vs. residential scale, renewables vs. nonrenewables vs. the in between), everyone in the space might tell you something different. There’s probably a lesson here about the nature of truth and what it takes to find it. But basically the energy landscape is so vast that specialists often have very different perspectives on what they think will work and what won’t.

We’re at an inflection point in demand. Energy is an exciting (and very necessary) place to be right now. As I mentioned above, total demand is projected to double as hyperscalers search for 24/7, high-output energy sources to power AI and cloud infra.

The transition is moving both faster and slower than you might think. We’re probably both slightly better off and worse off than you imagine re: the clean energy transition. Regulatory changes are less of a headwind than you probably think, but that doesn’t mean they’re easy to navigate.

This reality check isn’t meant to be daunting - just meant to prepare you for what’s ahead.

Software vs. Energy

Coming from tech, I’ve noticed stark contrasts between scaling software and energy solutions. These inform how we should approach energy:

Scaling software is comparatively straightforward:

you have clear ICPs / target customers (and if you have felt the thrill and tingle of true PMF, you know that selling your product should not be too hard)

very fast time to market (weeks, months, vs years)

immediate user experience improvements

capital-efficient growth & scale, quick returns

Where software is glitzy and scales rapidly and returns are hard and fast, clean energy solutions face fundamental challenges.

Energy is challenging to solve:

1) Extremely slow to market. Both from a technological innovation standpoint (more on this later) and an economic deployment one - it literally takes years to get one project approved. It has taken decades for renewables to reach commercial viability.

2) The user experience is bad. Consider how often there are power outages in rural areas - in 2023, about 33.9 million (1 in 4 households) in the US were completely without power at least once in the past year. ~70% or 23.6 million of the households reporting an outage said at least one outage lasted 6 hours or more.2 This is because grids are fragmented and transmission lines are old and need upgrading. Not only is the system unreliable, it’s also expensive. The cost of electricity has increased from $0.14 per kilowatt hour in 2019 to $0.18 per kilowatt hour in 2024, more than 28.5% increase.3

3) Clean energy is expensive to produce.4 There are very laborious, very capital-intensive processed involved even before generating a single kilowatt hour. Development is highly regulated, with hurdles at every stage.

Understanding these differences is crucial for anyone looking to dive into the space, especially coming from tech. Energy veterans are often frustrated by silicon valley attempts to slap a pure software solution on this very infra-driven space.

The journey of a wannabe solar project

To illustrate some of this complexity, let’s walk through an example of completing a solar development project:

site selection:

first identify viable land (ideally mostly-sunny)

verify that the land has been zoned for renewable projects

do an environmental impact assessment on local wildlife, vegetation, etc.

create mitigation plans

land acquisition & leasing:

secure the rights to land (purchase or long-term lease)

permitting:

apply for federal, state-level, or local permits (often dozens)

engage community - may have to deal with NIMBYs. this is a very time-intensive process. there are many permits to obtain.

interconnection queue:

submit your project to utility or appropriate ISO (independent system operator) / RTO (regional transmission organization). it may be here for years (more on this bottleneck later)

transmission upgrades:

probably have to fork up millions in transmission upgrades that you pay to the utilities company manning the transmission lines to the project it approved

financing:

get the project financed (requires all sorts of complex financing structures including debt, tax equity, PPAs (power purchasing agreements, grants, and other things)

procurement / construction:

design engineering plans

procure materials (supply chain issues abound considering how reliant we are on Asia)

contract with manufacturers / construction firms. test these system

implementation / operation:

finally begin commercial operations

maintain a 25+ year life span

This entire process can take ~5-7 years depending on size.

Note that while energy may not scale like software, there are certainly roles for tech - especially software/AI-enabled hardware solutions in accelerating the transition, especially around grid management systems. But to understand these areas of opportunity, we have to understand the many existing problems in energy.

Understanding root problems requires some structured thinking. Let me try to paint in very not MECE, extremely simplified strokes, what the state of the world is:

Energy buckets

I think of “energy” - and the process above - in three buckets:

Generation & storage

Think of non-renewable sources like oil & gas and renewables like solar (example above), wind, hydro, nuclear - generation is the production of these sources of energy, storage would be batteries

Grid & transmission infra

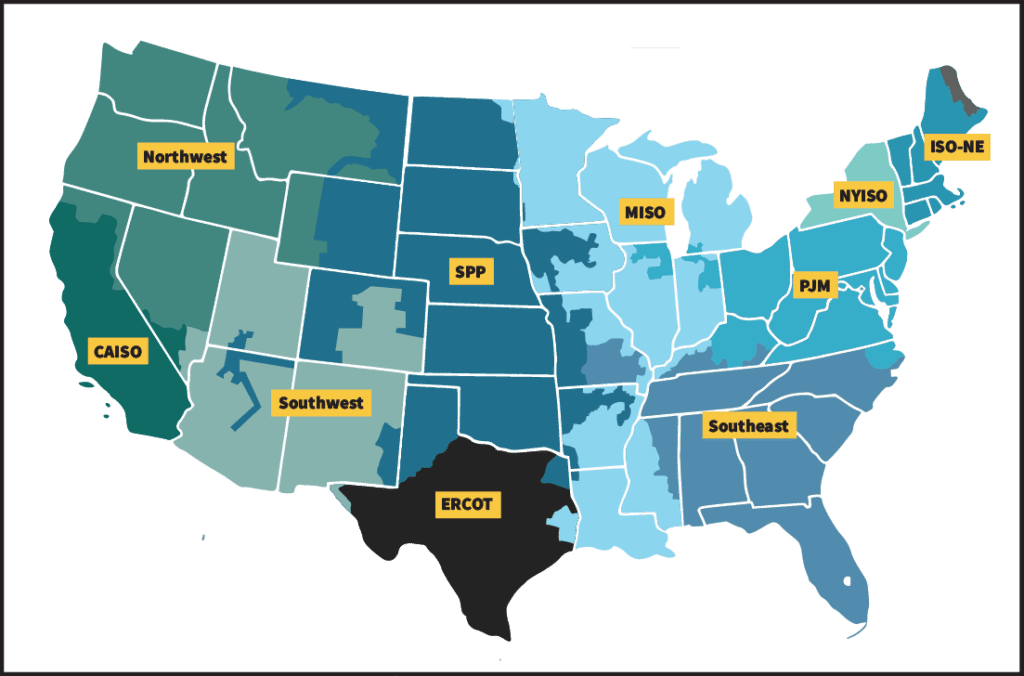

The grid (there are actually ~7 disparate large-scale grid systems in the US & North America broadly across geographical areas, with Texas having its own grid - ERCOT) is where energy generation coalesces - energy “goes to the grid” when it comes online after production. This energy is for use broadly, by any and all entities that require energy. Transmission infra includes wires, transformers, inverters, all that allows energy to travel.

Distribution & end use management

Distribution encompasses local distribution networks and microgrids (more on this eventually), DERs (distributed energy resources - more on this later too), EVs, and energy efficiency systems (like smart metering - these measure and transmit energy consumption data in real-time). Basically, it’s how energy actually gets to and is used by end users.

Diving a bit deeper into each of these:

Generation & storage

Over the past few years there has been a massive recent uptick in production of solar, wind, and battery projects,5 largely thanks to many federal initiatives including the passing of the IRA and tax credits / incentives for clean energy in 20226. Quick but important side note: the IRA has been huge in terms of accelerating clean energy deployment. It allocated ~$97B in grants, with about 84% of that finalized by the Biden admin. The DOE has also helped finance clean energy projects such as $15B in loans for PG&E in California to modernize the grid to support clean energy coming online.

Solar and wind and batteries are not new - they’ve been around for decades. What’s notable is just how much is prepared to come online. This is in large part because the cost at which solar is manufactured. Today, utility-scale solar is cost-competitive with new natural gas plants in many regions, particularly where incentives and tax credits lower the cost of development.7 States like California are seeing solar production possibly outpacing gas this year.8 This cost parity is a significant milestone. This should be really exciting news.

The reality is that even with an increase in investment for renewables generation projects, there are very literal barriers to these projects coming online, including substantial upfront capital, interconnection and transmission constraints, and ongoing regulatory hurdles.

Grid & transmission infra

In the lifecycle of a solar project trying to get approved, one of the key bottlenecks is that a project must enter the interconnection queue. The interconnection queue is literally a queue where all proposed projects are submitted. Grid impact studies are done for each project in the queue to evaluate its potential impact - how much power it is expected to bring to the grid, modeled against how that coincides with the load that all the other projects in the queue might hypothetically bring on.

There has been a massive increase in renewables projects joining the queue in recent years. The size of projects is growing as well, which adds to time in the queue. For example, projects with 200+ megawatts (for reference 200MW could power ~180,000 average US homes, a mid-sized city like Salt Lake City, or charge 150,000 EVs) average more than 55 months in the queue.9 As a result, there is now more cumulative power stuck in the queue than is actually live on the grid today. Some projects will spend 5 or more years in the queue before even getting evaluated.

Once it’s a project’s turn to be evaluated, getting approved within a reasonable budget is just as, if not more difficult. The challenge for renewables projects is that they are often located in rural places that are more opportune for capturing sunlight or wind (places that are sort of in the middle of nowhere). There needs to be a way to transport that energy from the middle of nowhere to the grid, so it can be used. However, transmission lines are often old and need to be upgraded to handle that power. The necessary lines simply may not exist at all.

The burden of financing those transmission upgrades or new construction falls on the project developer - if they accept these terms, they may have to pay up hundreds of millions of dollars to the utility provider. Perhaps it is not so surprising then that only ~19% of projects that entered the queue from 2000 to 2018 reached commercial operation by the end of 2023.10

Distribution & end use management

Once projects get approved and are operationalized, it has to be delivered and leveraged by utility-scale consumers and residential communities and individuals alike.

Much of the existing distribution infra in the US is very old and not prepared to handle the increase in DERs (distributed energy resources), EVs, and new metering technology. The first reason is that managing the load for renewables is especially tricky is in the nature of renewable energy sources themselves.

The grid is not built to handle variable loads of energy. It is accustomed to handling a very constant level of output, such as that which is produced by nonrenewable sources like oil and gas.

The energy output schedule for renewables like solar and wind are unpredictable (imagine an instance where a big cloud covers the sun, prompting a sudden dip in power, or the wind goes from quiet to blowing harshly - this would create a huge spike in energy output). Huge spikes or dips in energy are not only trying on the literal infrastructure of the system, it also creates volatility in the energy market. This volatility makes it difficult for renewables to compete with more stable base loads of energy generated by sources like natural gas (especially for larger, constant energy needs like 24/7 power that datacenters of hyperscalers are demanding.)

It’s worth quickly noting that there is an entire industry around energy trading and arbitrage. If you have a system for aggregating your energy or have storage, you can sell your energy to the market when there is demand at high, buy when there is supply for low, and make a profit this way. This somewhat explains the dynamic between renewables and the uptick in batteries - batteries are needed as as form of power storage from times when generation is high, for times when generation is low.

The second reason the grid is unprepared lies in the introduction of newer, decentralized energy systems. A lens for thinking about how to manage grid volatility is CERs vs. DERs:

CERs are centralized energy resources. These are the large-scale power plants and storage systems (coal, gas, nuclear, utility-scale solar farms) we’ve been talking about. They provide the bulk of power generation for large populations, are owned by utilities, and are connected at the transmission level (bucket 2 above) because of high voltage.

DERs are distributed energy resources. This includes any small scale energy asset that generates, stores, or consumes energy - e.g., rooftop solar panels, residential batteries, EV chargers, even smart thermostats and heat pumps. They serve very specific sites, but can also be used to supply excess power to the grid. These are typically owned by individuals, smaller businesses, or community organizations and connected at the distribution level (bucket 3 above). Because these energy sources are decentralized, they can operate autonomously or as part of VPPs (virtual power plants).

A VPP is essentially software that aggregates energy across various sources (e.g., a cluster of homes, a hospital, EVs, etc.) which can be bought and sold to stabilize the grid.

The distinction here is important for understanding grid stability.

The grid was designed for one-way flow of power - the CER model. But DERs introduce bidirectional flow, which often requires grid updates and smart technology.

Grid congestion and bidirectional flows impact both reliability and pricing. The grid is congested because transmission lines are outdated and unable to carry additional electricity due to capacity limits (definitely not built for bidirectional flow.) If utilities incur additional costs to upgrade infra to manage grid stability, extra distribution costs may manifest for consumers.

Congestion affects pricing because electricity prices are determined by the cost of delivering power to a specific location (nodes). Congested lines = increased cost. DERs can cause negative pricing (the duck curve effect11) in areas with high solar output, and high prices in the evening due to decreased solar output.

Examples of companies that currently try to address these challenges for DERs through VPPs including Voltus, which aggregates DERs to provide demand response and grid balancing services, primarily targeting commercial and industrial clients. Another is Base Power, a startup based in Texas, which focuses on residential aggregates and small-scale assets. They integrate home batteries into a VPP network to provide backup power to homes and sell excess energy back to the grid.

What’s next: opportunity landscape

Energy is one of those few industries where the stakes are as high as the barriers to entry. Despite the many challenges, I see many opportunities for a once-in-a-generation transformation - with the right approach, the right incentives, and the right technologies.

In coming posts, I’ll share:

deeper dives on the viability of various energy sources: solar, wind, batteries, gas, nuclear, hydrogen

problem area-specific posts about ongoing possible solutions with new technology

explorations of white spaces - from long-duration storage to VPPs – and how each might help us build a more sustainable, resilient grid

progress on some side projects I’m working on in the space

Resources I’m liking lately (will share more each week!):

Heatmap: a newsletter on all things energy (often solar-specific)

CTVC: newsletter, insight + resources from climate tech vc

Canary Media: clean energy journalism

Catalyst by Shayle Kann: podcast featuring industry experts on a variety of topics in the clean tech space

The Grid by Gretchen Bakke: older book covering the history of the grid, helps for understanding the root of problems, where they came from

If you found this useful, please consider sharing with others! And feel free to reach out to share any thoughts or ideas!! I’m always looking to meet and talk to more people interested in these issues : )

https://www.thetimes.com/business-money/energy/article/ai-forecast-to-fuel-doubling-in-data-centre-electricity-demand-by-2030-htd2zf7nx?region=global

https://www.census.gov/library/stories/2024/10/power-outages.html#:~:text=About%2033.9%20million%20or%201,lasted%206%20hours%20or%20more.

https://www.cbsnews.com/news/price-tracker/

https://www.marketwatch.com/guides/solar/solar-farm-cost/

https://www.cleaninvestmentmonitor.org/reports/us-clean-energy-supply-chains-2025#:~:text=Since%20the%20IRA's%20enactment%2C%20battery,announcements%2C%20and%20limited%20capacity%20expansion

https://www.epa.gov/green-power-markets/summary-inflation-reduction-act-provisions-related-renewable-energy

https://pv-magazine-usa.com/2024/06/11/cheapest-source-of-fossil-fuel-generation-is-double-the-cost-of-utility-scale-solar/#:~:text=Coal%20LCOE%20ranges%20$69%20to%20$169%20per,with%20an%20average%20of%20$182%20per%20MWh.

https://www.canarymedia.com/articles/solar/california-clean-energy-gas-power

https://www.latitudemedia.com/news/the-us-interconnection-queue-is-twice-its-installed-capacity/#:~:text=The%20average%20200%2B%20MW%20project,has%20a%20finalized%20interconnection%20agreement.

https://www.energytrend.com/news/20240416-46487.html

https://www.energy.gov/eere/articles/confronting-duck-curve-how-address-over-generation-solar-energy#:~:text=The%20duck%20curve%E2%80%94named%20after,demand%20peaks%20in%20the%20evening.